Address

304 North Cardinal

St. Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

Address

304 North Cardinal

St. Dorchester Center, MA 02124

Work Hours

Monday to Friday: 7AM - 7PM

Weekend: 10AM - 5PM

Getting braces is a significant step towards achieving a confident, straight smile, but it also comes with a financial commitment. Life can present unexpected financial challenges, making it difficult to continue payments for orthodontic treatment.

Patients undergoing braces treatment may face uncertainty if they lose insurance coverage. Understanding the implications of losing insurance during treatment is crucial for maintaining orthodontic care without interruption.

This guide addresses the most pressing questions about insurance loss during braces treatment and provides actionable solutions to ensure a smooth continuation of orthodontic treatment.

Insurance coverage plays a significant role in reducing the financial burden of orthodontic treatments. When individuals and families have good insurance, a substantial portion of the total cost is typically covered, making orthodontic care more accessible.

Most insurance plans that cover orthodontics pay a percentage of the total treatment cost, usually between 25-50%, up to a lifetime maximum benefit amount. For instance, a plan might cover 50% of the costs associated with braces, including initial consultations, X-rays, diagnostic tests, and follow-up visits.

Understanding the specifics of your insurance policy is crucial. Coverage limitations may include exclusions for certain types of braces or restrictions on pre-existing conditions. Moreover, policies often have a lifetime maximum benefit, typically ranging from $1,000 to $3,000, which represents the total amount your insurance will contribute toward orthodontic care.

When insurance coverage ends during braces treatment, patients often face unexpected financial burdens. Orthodontic treatment is a significant investment, and losing insurance coverage can disrupt the treatment plan and overall costs.

Losing insurance during braces treatment can lead to several consequences, including treatment interruptions or even termination. If payments are discontinued, the orthodontist may pause or stop treatment, resulting in unfinished results or prolonged treatment times.

This can be particularly problematic for patients with complex orthodontic cases, as interruptions may significantly impact the final outcome.

The financial implications of losing insurance coverage during braces treatment can be substantial. Patients become responsible for the remaining costs, which can be a significant burden. The timing of the insurance loss also plays a crucial role, as losing coverage early in treatment means a larger remaining balance.

Patients should explore available options with their orthodontist, including potential payment plans or alternative financing arrangements to manage the remaining costs and ensure continued treatment.

When you lose insurance coverage mid-treatment, it’s crucial to act quickly to minimize disruptions to your orthodontic care. The first step is to contact your orthodontist and discuss your situation with them.

Reaching out to your orthodontic office as soon as possible is vital. They may have policies in place to assist patients who have lost their insurance coverage. Being proactive and transparent about your circumstances can help you find a solution that ensures your treatment continues without interruption. For instance, your orthodontist might offer in-house payment plans or other financing options to help make your treatment more affordable.

Key actions to take when contacting your orthodontist include:

Gathering all pertinent information regarding your previous insurance policy and orthodontic treatment is also essential. This includes documenting any claims submitted and the overall treatment progress. Such documentation can be useful if you need to appeal for assistance or look for alternative financing. Keeping records of any correspondence with your insurance provider is crucial, as this documentation can help resolve disputes or clarify coverage details.

Important documents to gather include:

By taking these immediate steps, you can better navigate the challenges of losing insurance coverage during orthodontic treatment and find a way to continue your care with minimal disruption.

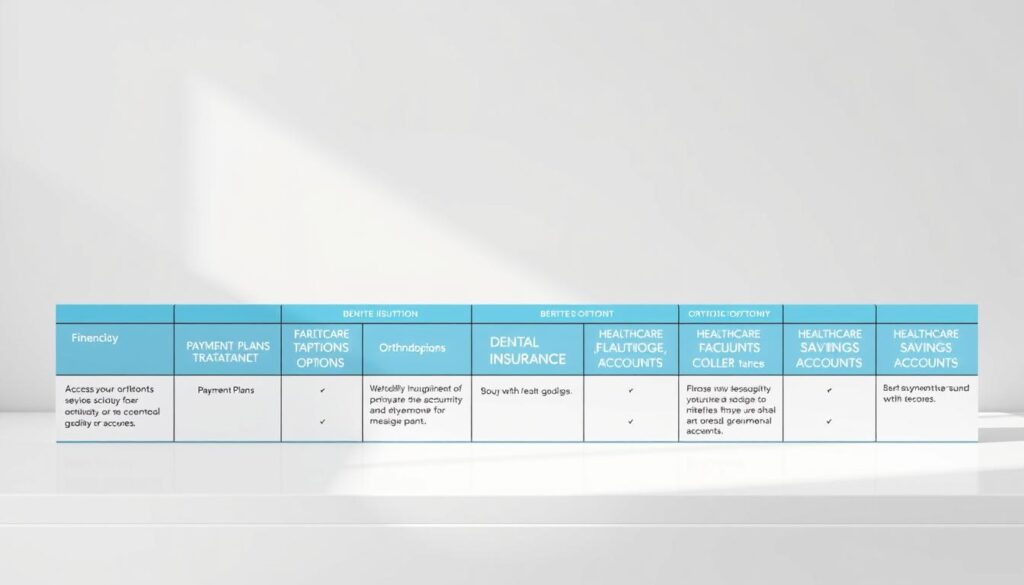

When insurance coverage ends, patients often need to explore new payment alternatives to continue their orthodontic treatment. Understanding the available options can help manage the financial burden and ensure that treatment progresses without interruption.

To manage the remaining costs effectively, it’s essential to request a detailed breakdown from your orthodontist. This breakdown should include the original treatment cost, the amount covered by insurance, and your new financial responsibility. The average cost of braces in Florida, for instance, can range from $3,000 to $7,000, depending on the complexity of the case and the type of braces required. Knowing these costs helps in planning and allocating funds for future payments.

Many orthodontists offer in-house payment plans designed for patients who lose insurance mid-treatment. These plans allow spreading the remaining costs over several months without third-party financing, often featuring lower or no interest rates and no credit checks. Some practices may offer discounts for patients who pay the remaining balance in full or for those experiencing financial hardship. Discussing your financial situation openly with your orthodontist can lead to a customized payment plan that works for both parties.

When insurance coverage ends unexpectedly, exploring new insurance options becomes a priority. Losing insurance during orthodontic treatment can be challenging, but there are several alternatives to consider for continuing care.

Utilizing the Health Insurance Marketplace is an effective way to find new coverage options. Many marketplace plans offer dental coverage as an add-on, which may include orthodontic benefits. However, the specifics of orthodontic coverage can vary significantly between plans, including waiting periods, coverage percentages, and lifetime maximums.

It’s essential to review the details of each plan carefully, especially if you’re already undergoing treatment. Some plans may exclude pre-existing treatment or have limitations on coverage.

For those who qualify, Medicaid and the Children’s Health Insurance Program (CHIP) can provide orthodontic coverage. These programs typically cover children under 18 with medically necessary treatment needs. To qualify, you’ll need documentation from your orthodontist establishing the medical necessity of the treatment.

Researching the specific eligibility requirements and coverage details in your state is crucial. In Florida, for example, certain orthodontic services are covered for children with specific medical needs.

When insurance coverage ends during orthodontic treatment, exploring financing options becomes crucial for continuing care. Many orthodontists offer in-house financing plans that allow patients to spread the cost of braces over time.

CareCredit is a popular financing option for orthodontic treatment. It offers special financing options, including no-interest periods if payments are made on time. Many orthodontists accept CareCredit, making it a convenient choice for patients.

If you have a Health Savings Account (HSA) or Flexible Spending Account (FSA), you can use these funds to pay for orthodontic expenses. These accounts use pre-tax dollars, reducing your out-of-pocket costs.

| Account Type | Benefits |

|---|---|

| HSA | Pre-tax dollars for medical expenses, including orthodontic care. |

| FSA | Pre-tax dollars for qualified medical expenses, including orthodontic treatment. |

The key to continuing your orthodontic care lies in understanding your options and communicating effectively with your orthodontist. Losing insurance during braces doesn’t have to derail your journey to a healthy, beautiful smile. By being proactive and exploring alternative payment options, you can maintain consistent care without compromising your treatment results.

Consider combining multiple approaches, such as using HSA/FSA funds for immediate expenses while setting up a payment plan for remaining costs. It’s essential to prioritize your regular appointment schedule to avoid extending your overall treatment time. By staying informed and working closely with your orthodontic team, you can navigate insurance changes and achieve your desired smile.